My friends, Amanda, is here from the business dance coach on YouTube, and I help self-employed Smiths owners master their money and grow their business. In today's video, I'm gonna show you how to catch up on your accounting records when you use cash, meaning your customers or clients pay you in cash or you use cash to pay for your business expenses. Ultimately, the records you have to get caught up in your accounting are paper documents like receipts. In this worksheet you see here on the screen, "Catch up cash records," this is from a new spreadsheet template I'm giving away called "Accounting Setup and Catch Up." Just to clarify, if you have receipts from debit and credit card usage, which are primarily used for business, be sure to check out my next tool in my next video called "Catch Up Bank Statements," because you should probably use that technique first. This template is for when you really don't have a bank or credit card account to use to catch up on your records and instead, you have to use your paper documentation. So, what this template allows you to do, as you can see, is label each column here according to your account categories that you have for your business in your paper records. In this first section of two columns is for your earnings, any income or payments you receive, and you can just use one column if you like, or you could have more than two as well. In the second section, you see to the right, is for your business expenses. The first step here is to really take all of your paper documents and sort them. If you have them already sorted by month, or you want to sort them by month, then...

Award-winning PDF software

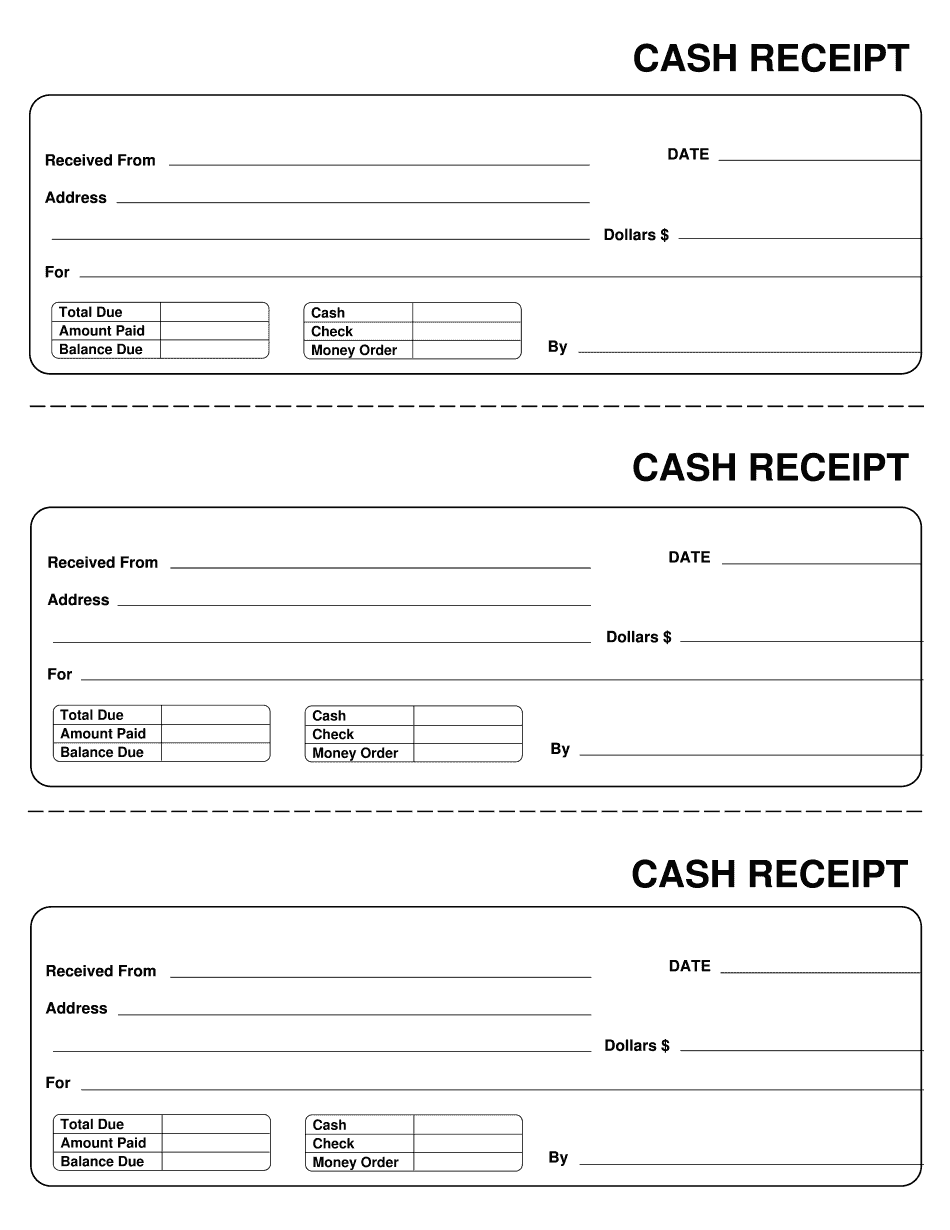

Fillable Cash Receipt Template excel Form: What You Should Know

Net 25 Free & Add-on Forms & Printable from the Business Tools Library — Vertex.net One of our favorite free business printable is the Complete Cash Receipt Template from the Business Tools Library. You will be amazed by the amount of information on this page, the form includes. 29 Free Cash Receipt Templates (Google Sheets and Excel) — Vertex.net 29 Free Cash Receipt Templates (Google Sheets and Excel) — Vertex.net We are very happy in the fact that this Google spreadsheet provides a lot of free form information, from the very first template. You will need to set up Google accounts and select the appropriate Google Sheet that will be used to import the file and then insert it onto the page. 28 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net 28 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net The most important page in this page is the “Payment” section, which enables you to enter each invoice amount and payment date. With so much details the next steps would be easy: add a line for a receipt, make a change in the “Payments” field and print the form to fill. 29 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net 29 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net The most important page in this page is the “Payment” section, which enables you to enter each invoice amount and payment date. With so much details the next steps would be easy: add a line for a receipt, make a change in the “Payments” field and print the form to fill. 29 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net 29 Free Cash Reciprocation & Accounting Templates from the Business Tools Library — Vertex.net The most important page in this page is the “Payment” section, which enables you to enter each invoice amount and payment date. With so much details the next steps would be easy: add a line for a receipt, make a change in the “Payments” field and print the form to fill.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cash Receipt Template, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cash Receipt Template online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cash Receipt Template by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cash Receipt Template from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fillable Cash Receipt Template excel