Hey everyone, stick around to hear it for this week's rock star minute. We're talking about rental receipts. It's that time of year. First, why am I outside in minus 20-degree weather in a t-shirt? There is no other reason than to get your attention. I don't know if it worked or not, but we figured we'd try something. So, we gotta take this quick because I can feel my skin freezing as we do this. Read receipts are not complicated at all, but it is the time of year to get some to your tenants. There's one trick or a couple of tricks because people were asking us what to do. You don't need to write individual receipts for every rent. We provide a template that we use on a single sheet of paper. This is from Carol in our office, who submits them to all our tenants. So, she prints this off, but there's a big trick. You actually have to sign the rental receipt. The Canada Revenue Agency (CRA) wants a signature of the landlord. So, we actually print them off and she signs as our representative. She signs as the landlord for some of them too, I'm not sure. But she signs them because in the past, we weren't doing that. Years ago, we had tenants coming back saying, "Hey, the CRA didn't accept the rental receipt as valid because there was no signature on it." So, save yourself a step. You don't have to do it a second time. You don't need to get that second email saying you need an updated rental receipt. It's pretty simple stuff that doesn't have to be complex. Don't overthink it. Microsoft Word templates work perfectly fine. I think that's it. My hands are starting to feel numb. I'd freeze. So until next...

Award-winning PDF software

Rent Receipt example Form: What You Should Know

Sept 3, 2025 — The housing industry is evolving and changing fast. It's important that you understand how to get the rent in the mail. FREE Rental Reciprocity Form Templates — forms Feb 15, 2025 — You can print the free rental receipts template, or save it on the hard drive for later use. Each rental receipt template includes the following information: 1. Form Number 3 A free rental receipt template for the use of tenants. Each template must be used in its entirety, including all the required information. (i.e. rental payment information, rental number, mailing address, and receipt number.) Rent Receipt [10 Pages] May 4, 2025 — The free rental receipt is a form you can use to print, print (PDF), or save the receipt on the computer. July 2025 — The free rental receipt template was provided by The Rental Supply Foundation. The free rental receipt template comes complete in Word, Excel, or HTML format. It features a blank form with space to fill in rental details, which can be updated from the spreadsheet on this site. The free rent receipt template is in .pdf format. Free Rent Receipt Templates — Print — Print (PDF) — Save — Email May 30, 2025 — Rent checks have the property's name on them, and they are useful to know if you need to claim back the rent from a tenant. With the Rental Supply Foundation free rental receipts form, you can save your receipts and mail them to the property or the tenant. Each form contains a checkbox to enter the amount that the tenant paid, the name of the landlord, the date and time the rent was paid, and the amount of the rent. The form has blank and filled-in form fields and space to allow the landlord to enter any additional information to make their receipt more user-friendly. Rental Supply Foundation rent receipt form template Dec. 18, 2025 — A free rental receipt is a useful document to keep a record of the amount of rent, including both short- and long-term rent payments. Rent receipts are also useful in order to show the actual amount of rent each tenant has paid. The Rental Supply Foundation free rent receipt form includes an information box that allows you to enter whether the rent was paid in cash and where the rent was paid. The free rental receipt form allows for up to 8 checks.

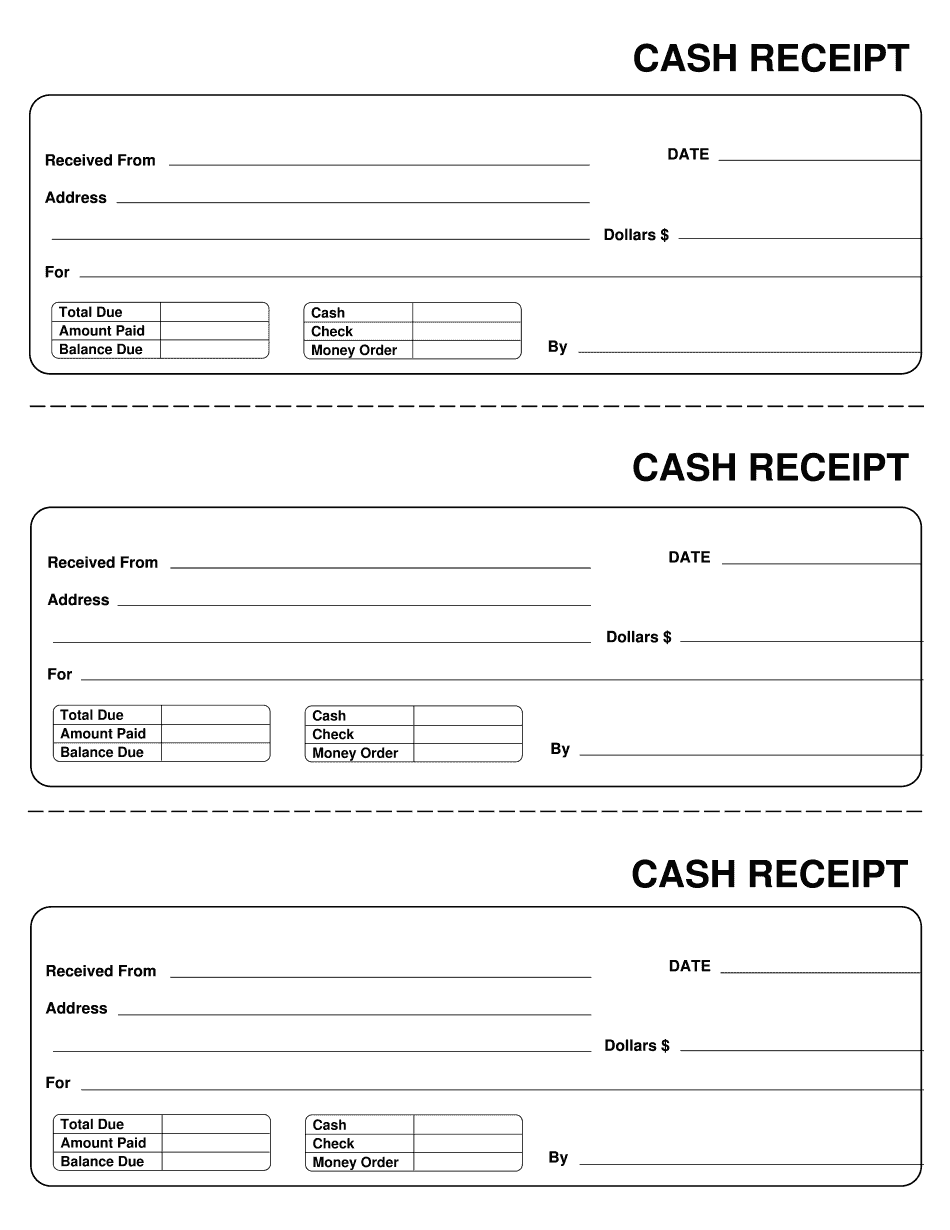

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cash Receipt Template, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cash Receipt Template online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cash Receipt Template by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cash Receipt Template from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rent Receipt example