Award-winning PDF software

How to prepare Cash Receipt Template

About Cash Receipt Template

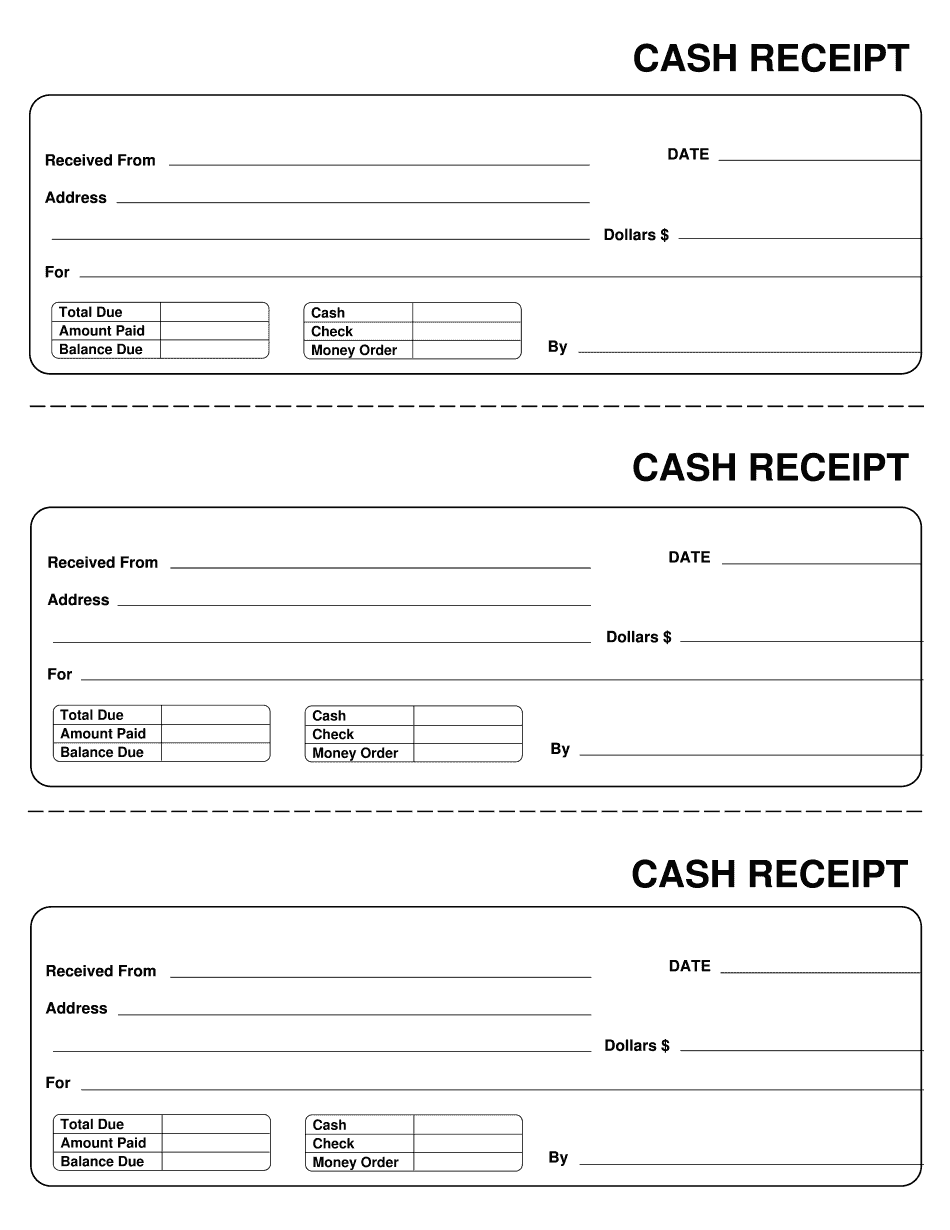

A cash receipt template is a pre-designed layout or format that helps in recording cash transactions. It is considered a crucial document for businesses or individuals who rely on cash transactions. It allows the accurate and efficient tracking of the cash inflow, outflow, and balance. The template typically includes sections for the date, details of the transaction, the amount received in cash, the purpose of the payment, and the signature of the recipient. It may also include other pertinent information such as tax or discount details. The cash receipt template is necessary for businesses that engage in cash transactions, including retail stores, food and beverage establishments, and service-oriented businesses. It is also essential for entrepreneurs, small business owners, freelancers, or anyone who receives payment in cash for goods or services. It helps them keep track of their financial transactions, manage financial records, and provide documentation to their clients or customers. In summary, the cash receipt template is an essential tool for maintaining financial records and ensuring the accuracy of transactions. Anyone who engages in cash transactions or provides services for cash payments should use a cash receipt template.

Online solutions assist you to organize your file administration and improve the efficiency of your workflow. Observe the quick tutorial to be able to complete Cash Receipt Template, stay clear of errors and furnish it in a timely manner:

How to complete a Receipt?

-

On the website with the document, click Start Now and pass to the editor.

-

Use the clues to fill out the applicable fields.

-

Include your personal data and contact information.

-

Make sure that you choose to enter suitable data and numbers in correct fields.

-

Carefully check the information of your form as well as grammar and spelling.

-

Refer to Help section in case you have any issues or contact our Support team.

-

Put an electronic signature on the Cash Receipt Template Printable with the support of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the prepared blank via email or fax, print it out or download on your gadget.

PDF editor will allow you to make changes to your Cash Receipt Template Fill Online from any internet linked gadget, customize it in accordance with your requirements, sign it electronically and distribute in different approaches.